Проверить штрих-код товаров

Проверить штрих-код в нашем не очень честном мире – это необходимый атрибут образа жизни. С помощью этой программы можно определить подделку, и, как минимум, потребовать скидки на товар, который собираетесь купить. Еще одно достоинство программы – определение страны-производителя. Зачем покупать товар, заявленный, как произведенный в Европе, на самом деле являющийся типичным китайским ширпотребом.

Введите в поле цифры и нажмите кнопку Проверить штрих-код

Да, да, не удивляйтесь. Каждый товар имеет свой официально зарегистрированный номер, который печатается на этикетке в виде черно-белых полосок. Внизу находится ряд цифр. Это и есть штрих-код (barcode). Эти бело-черные полоски с цифрами или штрих-код могут многое рассказать о товаре и его производителе.

Совершая покупку, наверное, совсем не лишним будет определить подлинность штрих-кода, а значит, страну, где был произведен товар, а также проверить, существует ли компания-производитель, имя которой указано на этикетке и зарегистрирован ли данный товар официально.

Самые распространенные штрих-коды — это 13-разрядный европейский код EAN-13 (European Article Numbering) и полностью совместимый с ним 12-разрядный код UPC, применяемый в США и Канаде.

Для проверки подлинности штрих-кода товара (кроме книг) введите все 13 цифр, которые находятся по бокам и внизу.

Если Ваш товар имеет 12 цифр на штрих-коде, то введите только 12 цифр.

Введите в поле цифры и нажмите кнопку Проверить. Если штрих-код подлинный, то Вы получите сообщение, выделенное зеленым цветом, «Штрих-код подлинный!» и ниже — информацию о стране-производителе товара.

Если после проверки штрих-кода появляется сообщение, выделенное красным, «Штрих-код не является подлинным!», советуем еще раз подсчитать количество и сверить введенные в поле цифры со штрих-кодом на этикетке товара. Если ошибка повторилась, значит, Вам не повезло.

ПРИМЕЧАНИЕ: Нередко на товаре можно увидеть надпись, например, «Сделано в Германии», а штрих код не соответствует этой стране.

Причин может быть несколько:

- фирма была зарегистрирована и получила штрих-код не в своей стране, а в той, куда направлен основной экспорт ее продукции;

- товар был изготовлен на дочернем предприятии;

- возможно, товар был изготовлен в одной стране, но по лицензии фирмы из другой страны;

- когда учредителями предприятия становятся несколько фирм из различных государств.

Расшифровка штрих кода

- С помощью первых двух цифр задается страна происхождения (продавца или изготовителя).

- Используя пять следующих – можно определить предприятие изготовитель.

- Для указания наименования товара, его потребительских свойств, размеров, массы, цвета служат следующие пять цифр.

- В конце кода находится контрольная цифра, определяющая правильность считывания штрих кода сканером.

Проверка правильности с помощью контрольной цифры

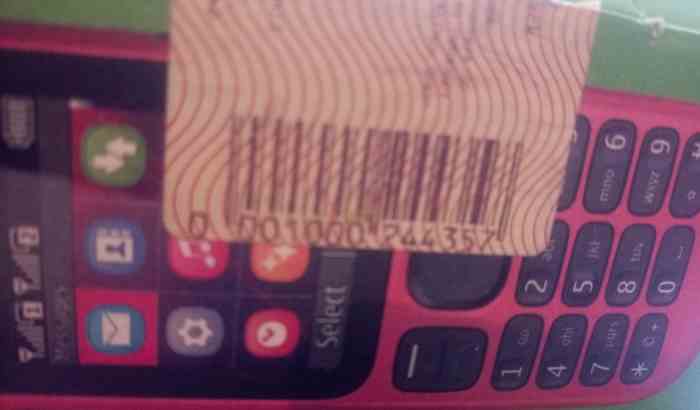

Лучше всего рассмотреть это на примере: берем дешевый телефон Нокиа и смотрим на штрих-код на коробке: 00 01 00 02 44 35 7.

| 1 | Складываем все цифры на четных местах ШК | 0+1+0+2+4+5=12 |

| 2 | Полученную сумму умножаем на 3 | 12*3=36 |

| 3 | Складываем нечетные цифры ШК, кроме контрольной | 0+0+0+0+4+3=7 |

| 4 | Складываем результаты п.2 и п.3 | 36+7=43 |

| 5 | Отбрасываем десятки | 43-40=3 |

| 6 | Вычитаем полученное число в п.5 от 10 | 10-3=7 |

Итак, как видим из таблицы код у нас правильный!

Таблицы штрих кодов по странам

| Страна | Штрих код | Страна | Штрих код |

| США Канада | 00-13 | Кипр | 529 |

| Франция | 30-37 | Македония | 531 |

| Болгария | 380 | Мальта | 535 |

| Словения | 383 | Ирландия | 539 |

| Хорватия | 385 | Португалия | 560 |

| Босния -Герцоговина | 387 | Бельгия Люксембург | 54 |

| Германия | 400-440 | Исландия | 569 |

| Япония | 45-49 | Дания | 57 |

| Россия | 460-469 | Польша | 590 |

| Тайвань | 471 | Румыния | 594 |

| Эстония | 474 | Венгрия | 599 |

| Латвия | 475 | ЮАР | 600-601 |

| Азербайжан | 476 | Маврикий | 609 |

| Шри-Ланка | 479 | Марокко | 611 |

| Филиппины | 480 | Алжир | 613 |

| Белоруссия | 481 | Кения | 616 |

| Украина | 482 | Тунис | 619 |

| Молдова | 484 | Сирия | 621 |

| Армения | 485 | Египет | 622 |

| Грузия | 486 | Иордания | 625 |

| Казахстан | 487 | Иран | 626 |

| Гонконг | 489 | Саудовская Аравия | 628 |

| Великобритания | 50 | Финляндия | 64 |

| Греция | 520 | КНР | 690-693 |

| Ливан | 528 | Норвегия | 70 |

| Израиль | 729 | Чехия | 859 |

| Швеция | 73 | Югославия | 860 |

| Гватемала | 740 | Северная Корея | 867 |

| Сальвадор | 741 | ||

| Гондурас | 742 | Турция | 869 |

| Никарагуа | 743 | Нидерланды | 87 |

| Коста Рика | 744 | Южная Корея | 880 |

| Панама | 745 | ||

| Доминиканская Республика | 746 | Таиланд | 885 |

| Сингапур | 888 | ||

| Мексика | 750 | Индия | 890 |

| Венесуэла | 759 | Вьетнам | 893 |

| Швейцария | 76 | Индонезия | 899 |

| Колумбия | 770 | Австрия | 90-91 |

| Уругвай | 773 | Австралия | 93 |

| Перу | 775 | Новая Зеландия | 94 |

| Аргентина | 779 | Малазия | 955 |

| Чили | 780 | Макау | 958 |

| Парагвай | 784 | Переодика | 977 |

| Эквадор | 786 | Книги | 978-979 |

| Бразилия | 789 | Оплата по чекам | 980 |

| Италия | 80-83 | ||

| Испания | 84 | Общие валютные купоны | 981-982 |

| Куба | 850 | ||

| Словакия | 858 | Купоны | 99 |